|

pet insurance companies phoenix guide to fair, accessible coverage and real costsWhy Phoenix context mattersHeat, desert hikes, and valley fever risk shape how coverage works here. Emergency clinics stay busy during summer spikes, and prescriptions for long courses of antifungals can add up fast. I'm comparing options because I want clarity on bills before the next surprise. What I'm actually looking for- Transparent pricing with no mystery "usual & customary" reductions.

- Short waiting periods, especially for orthopedic issues common in active dogs.

- Coverage that explicitly mentions valley fever testing and treatment.

- Reimbursement based on the invoice, not a regional fee schedule.

- 24/7 claim submission, quick e-pay, and bilingual support for families across the Valley.

- Reasonable treatment of preexisting conditions with medical review, not blanket denials.

Cost vs benefit, simplifiedPremiums I've seen for healthy young pets in Phoenix range from modest to surprisingly high. The tradeoffs hide in the details: deductibles, reimbursement rates, and annual limits. I first thought the cheapest monthly price would be safest; actually, that's not quite right - more precisely, the plan that limits total out-of-pocket during a bad month often wins. A higher deductible paired with 80 - 90% reimbursement can beat a low deductible if you face a $2,000 ER bill after a foxtail or heat exhaustion scare. A quick, real-world momentLast month at Steele Indian School Park, my dog got a cholla spine buried deep. The urgent care visit, sedation, and paw X-ray reached a few hundred dollars. I filed a claim on my phone in the parking lot; two days later, reimbursement landed after the annual deductible. It wasn't dramatic, just quietly helpful - exactly what I need from pet insurance companies Phoenix residents rely on. Coverage elements that matter here- Valley fever (coccidioidomycosis): diagnostics, long-term meds, follow-up bloodwork.

- Heatstroke emergencies: IV fluids, hospitalization, lab monitoring.

- Snakebite or cactus injuries: antivenom or sedation and imaging.

- Exam fees: included or excluded makes a real cost difference.

- Dental illness (not just accidents): abscesses, extractions.

- Behavioral care and alternative therapies (acupuncture, rehab) when prescribed.

- Older pet enrollment: fair rules without punitive age surcharges.

Fairness checks I insist on- Clear definition of preexisting conditions and any curable-condition exceptions after 6 - 12 symptom-free months.

- No lifetime or per-incident caps that quietly gut big claims.

- Rate increases tied to pet age and citywide claims trends, not unexplained jumps.

- Simple appeals process and access to full policy forms before purchase.

- Multiple ways to file claims: app, web, phone - important for accessibility.

- Spanish-language support and readable documents to keep coverage fair for more families.

How to compare pet insurance companies phoenix without pressure- Collect at least three quotes with the same deductible, reimbursement, and annual limit.

- Read the sample policy; scan exclusions and waiting periods, especially for ortho and hereditary issues.

- Call and ask local questions: valley fever protocol, heatstroke classification, and typical turnaround on ER claims in Maricopa County.

- Run two scenarios: a $350 urgent visit and a $3,000 hospitalization. Compare your total cost each time.

- Check their history of rate changes after year one.

Ways to lower total cost without underinsuring- Pick a higher deductible but keep at least 80% reimbursement.

- Choose an annual deductible, not per-incident, so it can "pay off" in a rough year.

- Ask about multi-pet or employee benefits discounts.

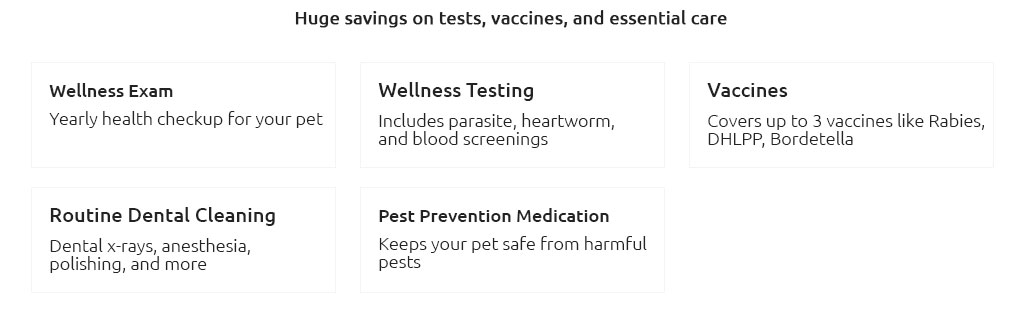

- Consider skipping wellness add-ons if your vet's routine costs are predictable and you can self-budget.

Red flags- Reimbursement based on "UCR" amounts instead of your actual vet bill.

- Orthopedic waiting periods stretched beyond the norm without a waiver exam.

- Bilateral condition exclusions that deny the second knee or eye automatically.

- Exam-fee exclusions that make every visit pricier than expected.

Small glossary- Premium: your monthly payment.

- Deductible: amount you pay out-of-pocket each year before reimbursements start.

- Reimbursement rate: 70 - 90% of the covered bill after deductible.

- Co-insurance: the part you pay after reimbursement (e.g., 20% if you have 80%).

- Annual limit: the most the policy will pay in a year.

- Waiting period: time after enrollment before coverage begins.

Questions tailored to Phoenix- Is valley fever testing/treatment covered, including long medication courses?

- Are heat-related emergencies considered accidents or illnesses?

- Do you cover antivenom and aftercare for rattlesnake bites?

- Is tele-vet included for triage on 110°F days?

- Does coverage follow us on road trips to northern Arizona or California?

Final thoughtI'm not chasing the lowest sticker price; I'm looking for coverage that treats Phoenix realities fairly and keeps care accessible. If a plan explains its rules clearly, pays based on the invoice, and supports fast claims, the monthly cost makes sense - especially on the days I hope I never need it.

|

|